Overview

Branch information must be supplied when submitting a document as part of the address information of the issuer to define which branch of the organization is issuing the document.

List

Branch information of the taxpayer organization is specific to the taxpayer. Different taxpayers can have the same branch ID information.

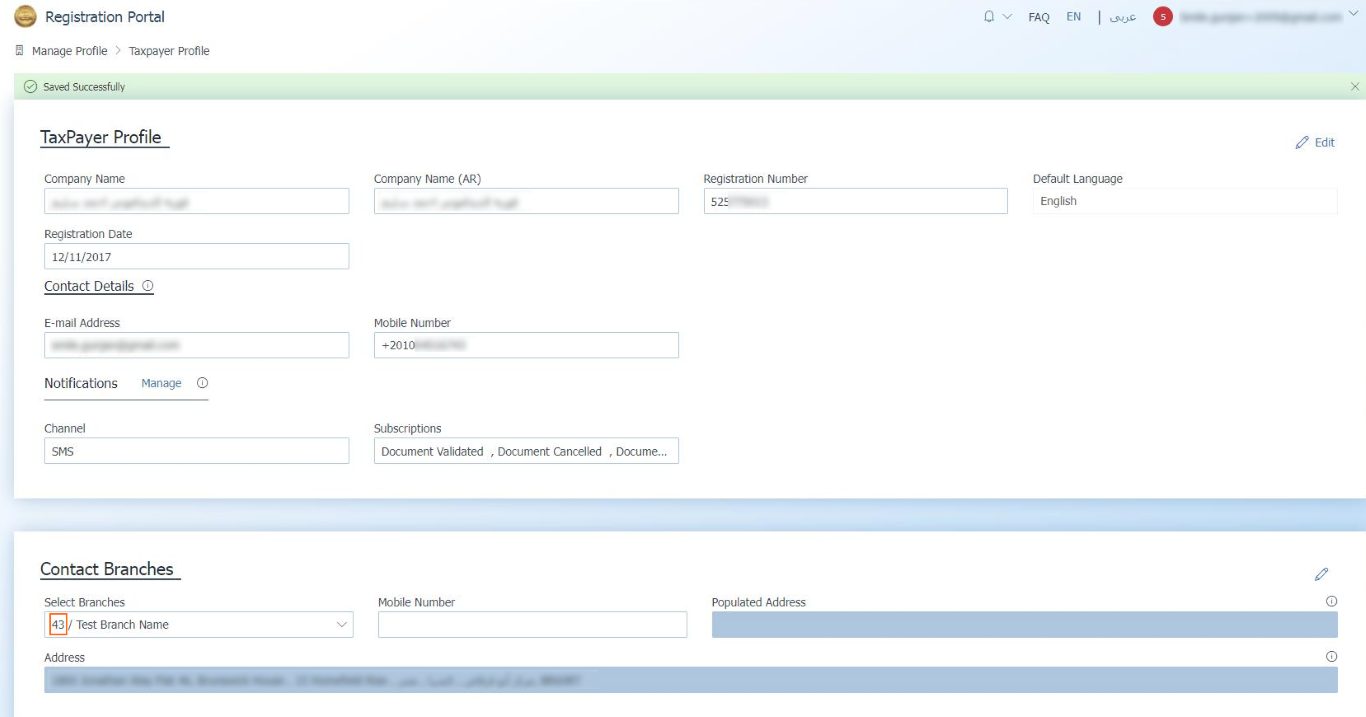

Therefore, to get information on the branch IDs that can be used to submit documents from a given branch, please visit the see taxpayer profile on eInvoicing portal and check the ID number displayed for the required branch.

The branch ID value for the selected branch location is highlighted in the image below. IDs of other branches can be seen by choosing another branch from the dropdown list.

Additional Considerations

Only branch ID information (not branch name) should be supplied as part of the document submissions.